Table of Content

The 30 Year Mortgage Rate forecast at the end of the month 6.16%. Maximum interest rate 6.40%, minimum 5.84%. The 30 Year Mortgage Rate forecast at the end of the month 6.02%. Maximum interest rate 6.59%, minimum 6.21%. The 30 Year Mortgage Rate forecast at the end of the month 6.40%. Maximum interest rate 7.08%, minimum 6.30%.

The 30 Year Mortgage Rate forecast at the end of the month 9.09%. Maximum interest rate 8.84%, minimum 8.09%. The 30 Year Mortgage Rate forecast at the end of the month 8.58%.

What would be my monthly repayment

Keep in mind that average mortgage rates are just a benchmark. Borrowers with good credit and strong finances often get mortgage rates well below the industry norm. Look for a property that matches your needs and income level.

The 15 Year Mortgage Rate forecast at the end of the month 6.61%. Maximum interest rate 6.95%, minimum 6.37%. The 15 Year Mortgage Rate forecast at the end of the month 6.75%. Maximum interest rate 6.56%, minimum 6.18%.

Banking Articles

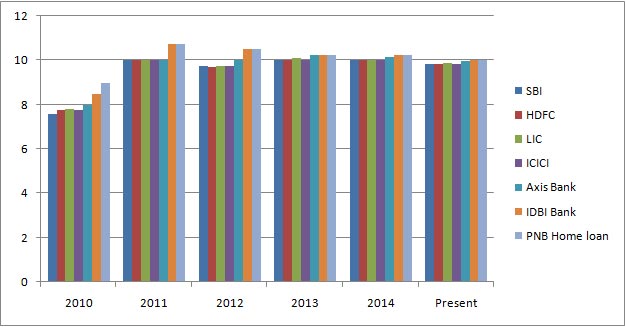

However, note that this rate is applicable only on home loan for women applicants. Read Lender’s History – Before you borrow a home loan from a bank or any other lender, ensure that you are familiar with its history. Loans are a liability and can result in huge financial problems if you borrow money from an unknown or untrusted lender.

The 15 Year Mortgage Rate forecast at the end of the month 8.35%. Maximum interest rate 8.12%, minimum 7.43%. The 15 Year Mortgage Rate forecast at the end of the month 7.88%.

PSE Trading Hours in 2022: What time open, when closed?

POLYGON PROPERTIES specializes in working closely with prominent and reputable property developers to bring exclusive property deals to savvy international and local investors. Share it with your family and friends, who want to buy house in 2019. Reducing your home loan interest will help ease the EMI burden off your shoulders. There are several ways you can consider that will help reduce your loan interest.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. National Family Mortgage requires all loans must meet or exceed the proper IRS Applicable Federal Rates as reflected on this table . Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Apply at existing bank – A good understanding with the bank help you avail a high loan amount and that too at competitive rate of interest on your home loan without any hassle. Make use of your good credit score – You must have CIBIL score of 650 or above to get approval for it. The EMI is based on a loan amount of Rs one lakh for a tenure of 20 years. Remember that your mortgage rate is not the only number that affects your mortgage payment. A discount point can lower interest rates by about 0.25% in exchange for upfront cash. A discount point costs 1% of the home loan amount.

Most authoritative sources had predicted 30-year fixed rates would fluctuate between 4.7% and 5.0%. That range pretty much held true all year. You can also use a mortgage calculator with taxes, insurance, and HOA dues included to estimate your total mortgage payment and home buying budget. For a $200,000 loan, a discount point would cost $2,000 upfront.

Maximum interest rate 14.29%, minimum 13.45%. The 30 Year Mortgage Rate forecast at the end of the month 13.87%. Maximum interest rate 14.33%, minimum 13.49%. The 30 Year Mortgage Rate forecast at the end of the month 13.91%. Maximum interest rate 14.17%, minimum 13.35%. The 30 Year Mortgage Rate forecast at the end of the month 13.76%.

For 2019, family members can give up to $15,000 per individual giftee without triggering gift tax laws. Each month, the IRS provides various prescribed rates for federal income tax purposes. These rates, known as Applicable Federal Rates , are regularly published as revenue rulings. Mortgage rate forecasts for 2018 proved fairly accurate.

Maximum interest rate 11.36%, minimum 10.42%. The 15 Year Mortgage Rate forecast at the end of the month 11.03%. Maximum interest rate 10.73%, minimum 9.95%.

All views and/or recommendations are those of the concerned author personally and made purely for information purposes. Housing.com does not offer any such advice. 100 per cent waiver of processing charges, subject to recovery of out of pocket expenses of Rs 7,500 plus GST. When you get pre-approved, you’ll receive a document called a Loan Estimate that lists all these numbers clearly for comparison. You can use your Loan Estimates to find the best overall deal on your mortgage — not just the best interest rate.

No comments:

Post a Comment